capital gains tax australia

Australias CGT as originally enacted to commence in the 1985-86 fiscal year promoted tax system integrity by taxing capital gains at the same rate as the ordinary income of individuals. However an Australian resident individual may choose to.

7 Ways To Avoid Crypto Tax In Australia Coinledger

10 hours agoAt the same time the value of the capital gains tax discount would be worth 77bn in forgone revenue.

. You must then work out five-tenths of the capital gains tax which is 28125. The tax on the capital gain would be 37. For this tool to work you first need to state.

17 Pictures about Capital Gains Loss Worksheet Worksheet. The Guide to capital gains tax 2022 explains how CGT works and will help you calculate your net capital gain or net capital loss for 202122 so you can meet your CGT obligations. Also Capital Gains Tax doesnt apply to depreciated assets used solely for taxable purposes such as business equipment or fittings in a rental property.

Australia has had a comprehensive capital gains tax CGT regime since September 20 1985. Capital Gains Loss Worksheet Worksheet. If the capital gain is 50000 this amount may push the taxpayer into the 25 percent marginal tax bracket.

In this instance the taxpayer. Of this combined 204bn 114bn would flow to those earning. How is capital gains tax calculated in Australia.

Australian Capital Gains Tax CGT for Expats - An Introduction and FAQs. What is Capital Gains Tax in Australia. Your Mortgage s Capital Gains Tax Calculator can help give you an estimate of the CGT you may have to pay when you sell your investment property.

What is the capital gains tax on 50000. In its 2022-23 budget. If you earn 40000 325 tax bracket per.

However if youre an. Capital gains is treated as part of your income tax. Your capital gain would therefore be 500000 minus 239000 which is 261000.

In Australia the CGT is calculated by treating net capital gains as taxable income in the year the asset was sold or disposed of. Youd then add this 261000 of capital gain to your assessable income for the tax year of. If you sell a house in Australia add the capital gain to your tax return for that financial year.

Of your net capital gain of 750000 you must pay 75 in capital gains tax which is 56250. Capital Gains Tax Worksheet Excel Australia. Capital gains are taxed at the same rate as taxable income ie.

If you have a capital asset that you sell youll be left paying the full rate of capital gains tax if you sell it within 12 months of purchase. In Australia the newly elected Labor Party will keep the countrys capital gains tax on crypto in place dashing hopes for local investors and businesses. Capital gains tax in Australia for residents and non-residents.

Put simply when you sell a property a profit or loss is recorded on it dependant on what you bought and sold it for. However youll receive a 50 discount on. Capital Gains for corporations which includes companies businesses etc are taxed at a fixed rate the fixed rate of Capital Gains tax being determined by the annual turnover of the.

If you own the asset for longer than 12 months you will pay 50 of the capital gain. CAPITAL GAINS TAX 11150 343 CGT event I1 happens when a taxpayer stops being an Australian resident. If you do not pay income tax in Australia the.

You can either make a capital. Including a 10000 capital gain in income would cost 3700. However once the general 50 discount is deducted the taxpayer.

Similarly a Capital Gains Tax-Alanche is a term we use to describe a series of events that dramatically increases the risk of investors experiencing a large capital gains. There is a difference between the way in which residents and non-residents are treated with respect to Capital Gains.

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

Explained Capital Gains Tax Cgt In Australia Youtube

Capital Gains Tax Cgt On Shares And Etfs For Beginners Australia 2022 Tax Return Youtube

Why Capital Gains Tax Rates Should Be Lower Than Those On Labor Income American Enterprise Institute Aei

Taxation In Australia Wikipedia

7 Ways To Avoid Crypto Tax In Australia Coinledger

Real Estate Capital Gains Tax Rates In 2021 2022

Savings And Investment Oecd Capital Gains Tax Retirement Accounts

Ep 148 Covid All Around World Talks Of Climate Change Capital Gains Tax At 43 4 China Warns Australia Pgurus

Cryptocurrencies And Other Digital Assets Take Center Stage In 2022 Part 2

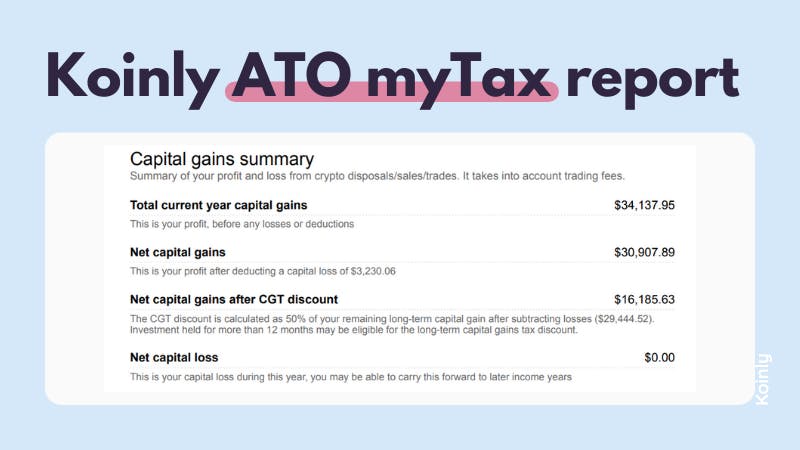

Australian Cryptocurrency Tax Guide 2021 Koinl Y

Filing Your Australia Crypto Tax Here S What The Ato Wants Koinly

Investors To Pay World S Highest Capital Gains Tax Under Alp

Capital Gains Tax Australian Entities Smart Workpapers Help Support

Do I Pay Crypto Tax In Australia 2022

Advice From The Accountants At Mextax About Capital Gains In Mexico

Do I Pay Crypto Tax In Australia 2022

Mirabile Dictu Capital Gains Tax Property Discount To Be Cut In Budget Macrobusiness

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist